Therefore, no amount is available on which to base the rent calculation. Similar to the treatment of prepaid rent, under ASC 842 the accruals are recorded to the ROU asset instead of a separate accrued rent account. Under ASC 842, you would see the same entries, but the prepaid rent would be recorded to the ROU asset in place of a separate prepaid rent account. Additionally, at the time of transition to ASC 842, any outstanding prepaid rent amounts would be included in the calculation of the appropriate ROU asset. However, under ASC 842, the new lease accounting standard, prepaid rent is now included in the measurement of the ROU asset.

Example: Straight-line rent expense calculation

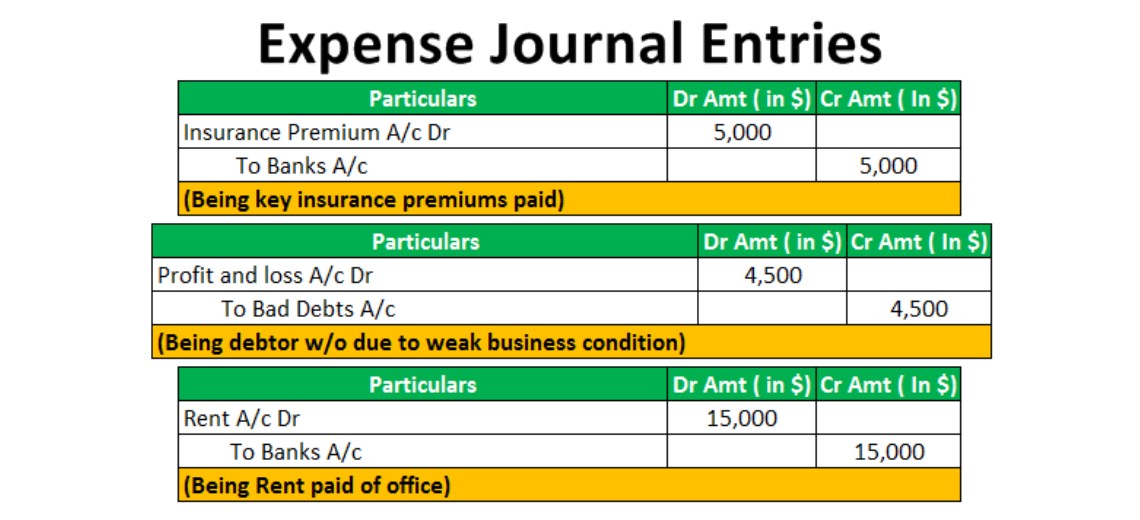

On the first day of the next month, the period the rent check was intended for, the prepaid rent asset is reclassed to rent expense. In a scenario with escalating lease payments, the average expense recorded is more than the lower payments at the beginning of the lease term. Eventually, the lease payments increase to be greater than the straight-line rent expense. In the case of the rent abatement above, the company begins paying rent but the payments are larger than the average rent expense which includes the abatement period. When we make the rent payment for the liability above, we can make the journal entry by debiting the rent payable account and crediting the cash account.

Rent Accounting for ASC 842: Prepaid Rent, Journal Entries, and More

Therefore the variable portion of the rent payment is not included in the initial calculations, only expensed in the period paid. The company can make the journal entry for the rent paid in advance by debiting the prepaid rent account and crediting the cash account. But for lease accounting, it can make things a little more difficult. Prepaid rent is rent that’s been paid in advance of the period for which it’s due.

How has accounting for rent payments changed under ASC 842?

An adjusting entry for the portion actually being applied at the end of each month. On the other hand, an adjusting entry will be made each month for the portion actually being applied at the end of each month. I’d be happy to share some information about the Accounts Payable account type. Or you can buy a Rent Demand form at a legal stationary store, like Blumberg.

Deferred rent is primarily linked to accounting for operating leases under ASC 840. Nevertheless, differences between lease expense and lease payments also exist under ASC 842. This comparison of deferred rent treatment under ASC 840 and ASC 842 is illustrated in Deferred Rent Accounting what real estate business expenses are tax deductible and Tax Impact under ASC 842 and 840 Explained. Under ASC 842 base rent is included in the establishment of the lease liability and ROU asset. The amortization of the lease liability and the depreciation of the ROU asset are combined to make up the straight-line lease expense.

Under ASC 840, Deferred rent is the amount represented when there is a difference between the cash paid for rent and the straight-line rent expense. It is important to note that the above referenced entries are how Prepaid Rent was accounted for under ASC 840. The concepts of Prepaid Rent are no longer recorded under ASC 842 as the payments are recorded as part of the ROU Asset.

- Hannifin follows a strict accrual system to maintain its accounts.

- We can make the journal entry for the accrued rent expense by debiting the rent expense account and crediting the rent payable account.

- Rent is paid by individuals and organizations for the use of a variety of types of property, equipment, vehicles, or other assets.

Example – On 1st January ABC Co. paid office rent amounting to 10,000 (5,000 x 2) for the month of January & February. Step 2 – Transferring office rent expense into income statement (profit and loss account). In conclusion, accounting for rent expense is changing insignificantly from ASC 840 to ASC 842. Now if only the same thing could be said about the accounting for operating leases.

Per ASC 842, the ROU asset is equal to the lease liability calculated in step 3 above, adjusted by deferred or prepaid rent and lease incentives. In this example, it is the liability of $11,254,351 minus the incentive balance of $200,000. A retailer enters into a 10-year warehouse lease with initial rent payments of $120,000 a month and a 2% annual rent escalation. The Landlord agrees to provide a $200,000 tenant improvement allowance to be paid upfront at the commencement of the lease.

Likewise, in this journal entry, the net impact on the balance sheet is zero as one asset (prepaid rent) increases while another asset (cash) decreases. This journal entry is made to eliminate the rent payable on the balance sheet that we have recorded in the prior period. Future payments for rent-related to operating leases were previously off-balance sheet transactions.